It was recently reported that the Girl Scouts have an excess of 15 million cookies currently unsold. In this age of instant consumerism, it seems worthy of digging into this and understanding this problem more. While the Girl Scouts of the USA places the blame on the pandemic, I would argue that it seems like one impetus but not the only one by a long shot.

So how does this tie to product management? It’s simple. The problem of 15 million unsold cookies is not addressed by the current distribution strategy. The digital solutions that Girl Scouts have built are a step in the right direction but do not meet the largest problem. A personal relationship is required to buy Girl Scout cookies.

Relationship + Desire = Purchase

🍪 But first some cookie history…

The first Girl Scout cookies were sold by the Mistletoe Troop in Muskogee, Oklahoma in 1917 -- the scouts baked cookies and sold them in a high school cafeteria as a service project, according to the Girl Scouts official website. Several other troops began baking and selling cookies throughout the '20s and '30s, and in 1935, the Girl Scout Federation of Greater New York raised money through the sale of commercially baked cookies for the first time. The following year, the national Girl Scout organization began the process of licensing the first commercial bakers to produce cookies that would be sold nationwide by troops.

Between January and April every year, the more than one million scouts in the U.S. sell about 200 million boxes of the cookies, Fortune recently reported. How much is that, in cookie terms? Girl Scout cookie sales top Oreos. They top Chips Ahoy and Milano combined.

📖 State of Affairs

The current reliance on individual Girl Scouts and their troops, becomes an even larger burden with the current unfortunate reality of shrinking memberships.

Cookies are made by 2 distributors and sold primarily via one channel: in-person by Girl Scouts. There has been some innovation into online marketplaces but by no means traditional cookie sales.

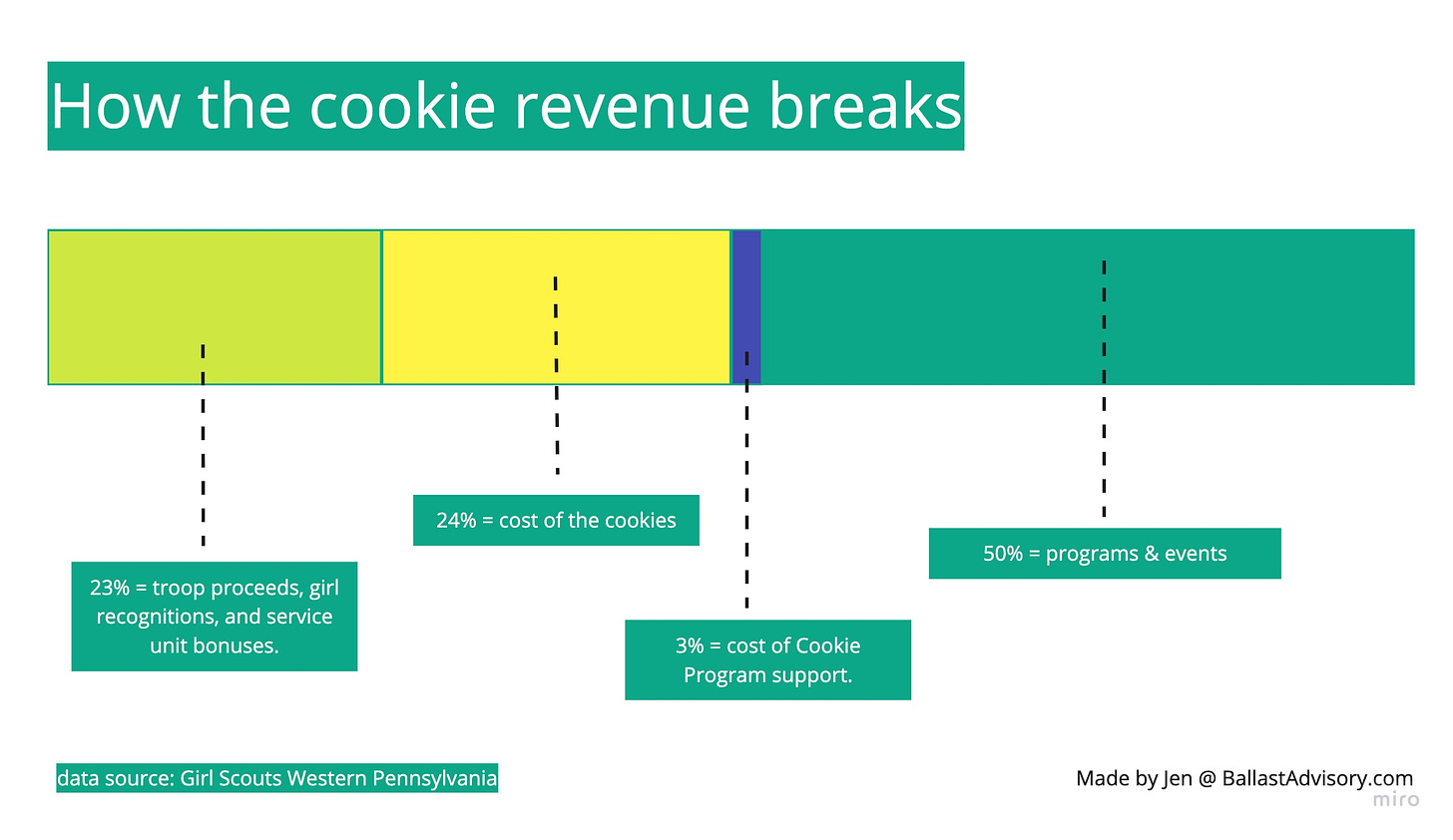

Girl Scouts developed an online sales platform in 2015 but it is not easily accessible to the masses. The cookie revenue is important to the local troops to fund activities and other enriching experiences. Here’s how the cookie revenue breaks out:

But - the downside to that is cookies are not accessible. Despite the 15 million unsold cookies, the only way to currently buy cookies (easily) is on Amazon and it doesn’t appear any of the sellers are authorized by Girl Scouts.

What are the facts?

15 million unsold cookies

membership has shrunk 30% since 2009

global pandemic has prevented traditional popup sales model

palm oil controversy

This feels like an opportunity to rethink the model.

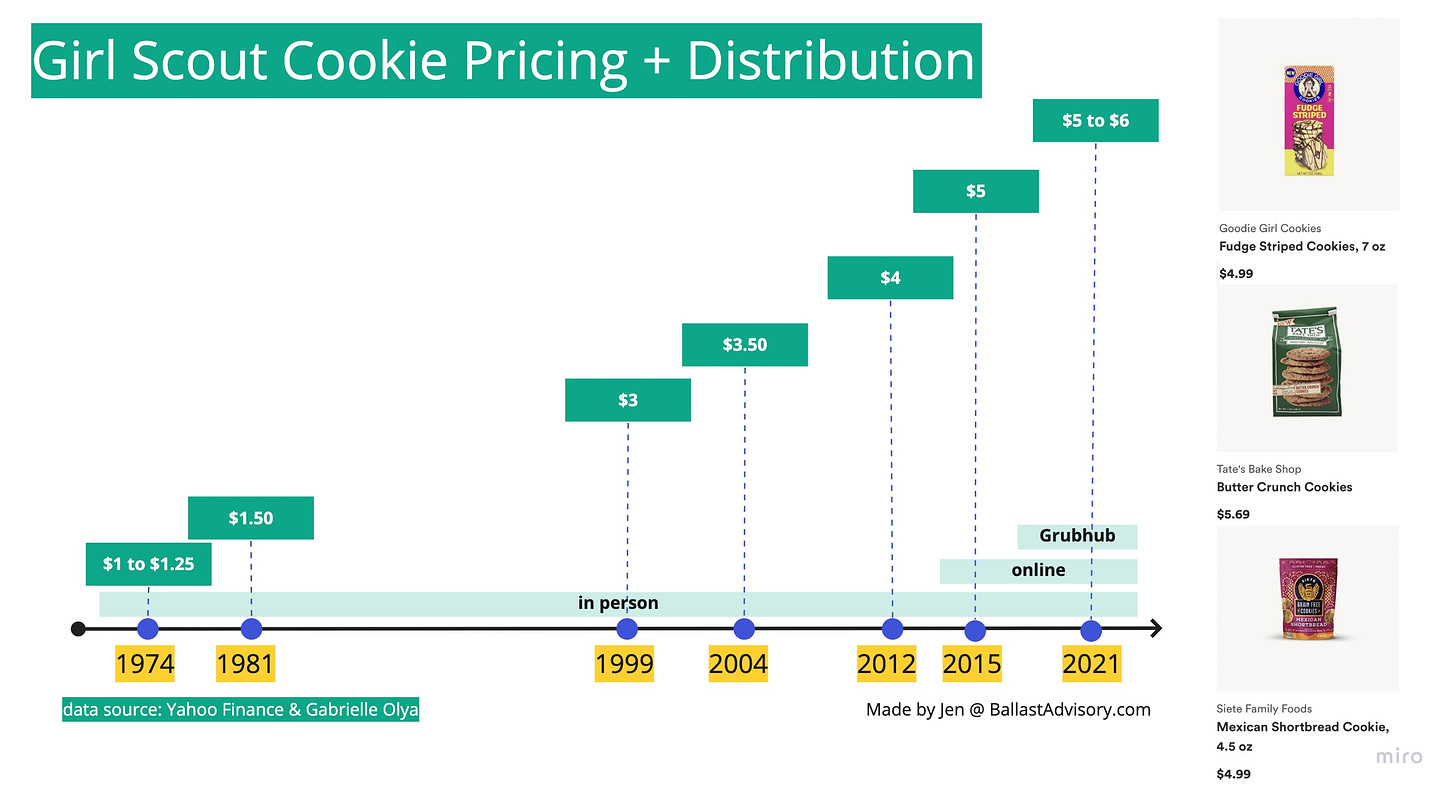

💵 Is pricing the problem?

While I don’t love the idea of paying $5-6 a box, I do not believe that the current pricing strategy is the cause for surplus. For sure this is more than a box of Chips Ahoy, but it is either inline or lower than other comparative brands. Additionally, the pricing increases for modern day cookie sales has been relatively stable.

💰 Opportunity = Shrinking sales channel + purchase barriers

As I see it, there is no evidence that demand has been affected. The hiccup is how to get cookies to the customers without devaluing/commoditizing the brand or losing margin to an online marketplace. (Side note, I believe the Goodwill marketplace is a great example of the opportunity that Girl Scouts is missing out on by requiring a direct relationship to purchase cookies.)

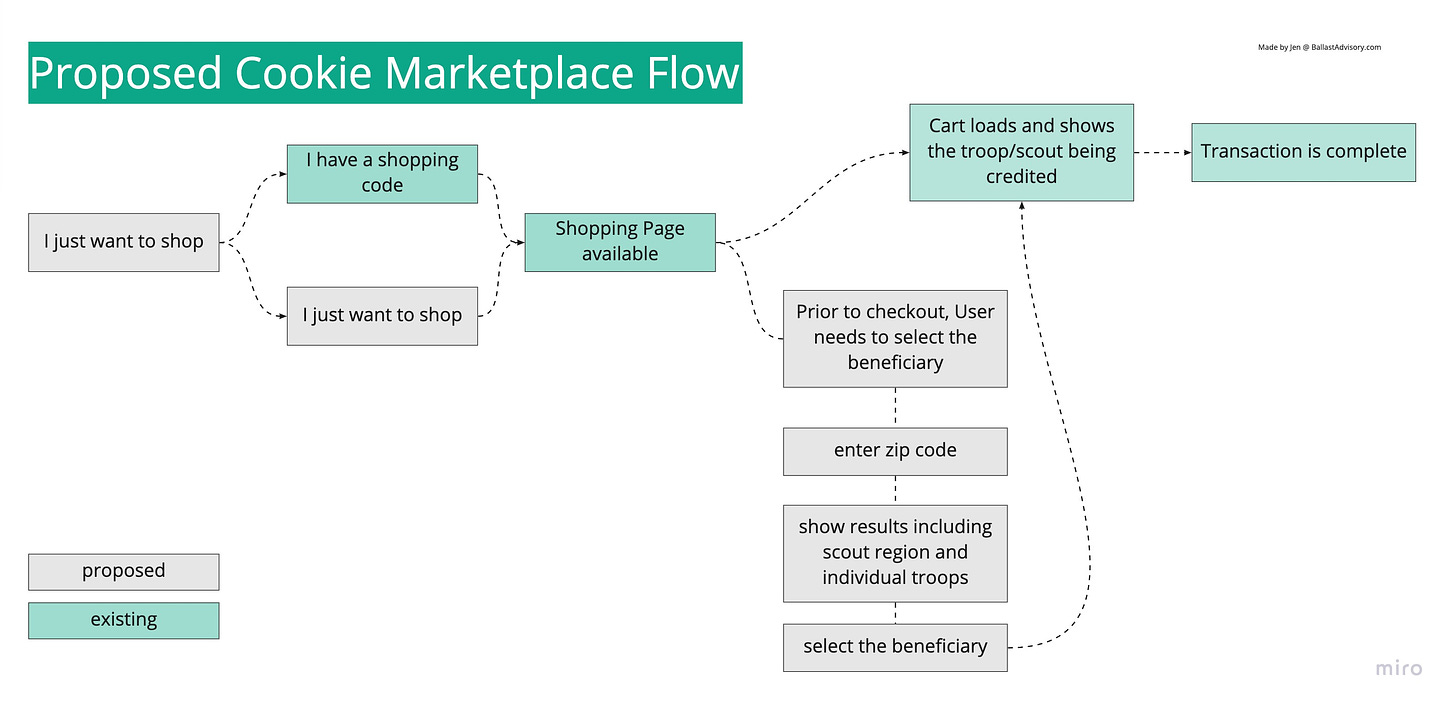

Potential Vision? A unified marketplace that enables consumers to purchase cookies regardless of knowing a Girl Scout. Consumers and Troops will still create a “shopping relationship” as part of the purchase but it is not required to have access to cookies.

Troops have individual stores on the platform

Other users can pick which troop they’d like to support by a handful of features (geography being the current primary driver)

If a shopper doesn’t have a specific troop, their purchase could be attributed to the appropriate state or geographic region, thus also enabling some passive fundraising opportunities.

The viral news coverage of Troop 6000 in NYC is a great example of how this potential platform model could be impactful on a larger level. Shoppers were drawn to the opportunity to support an inner-city, homeless troop. Why not enable shoppers to find other troops that could also benefit (Inner-city, Rural, POC, etc)?

📈 Potential Impact of Online Sales

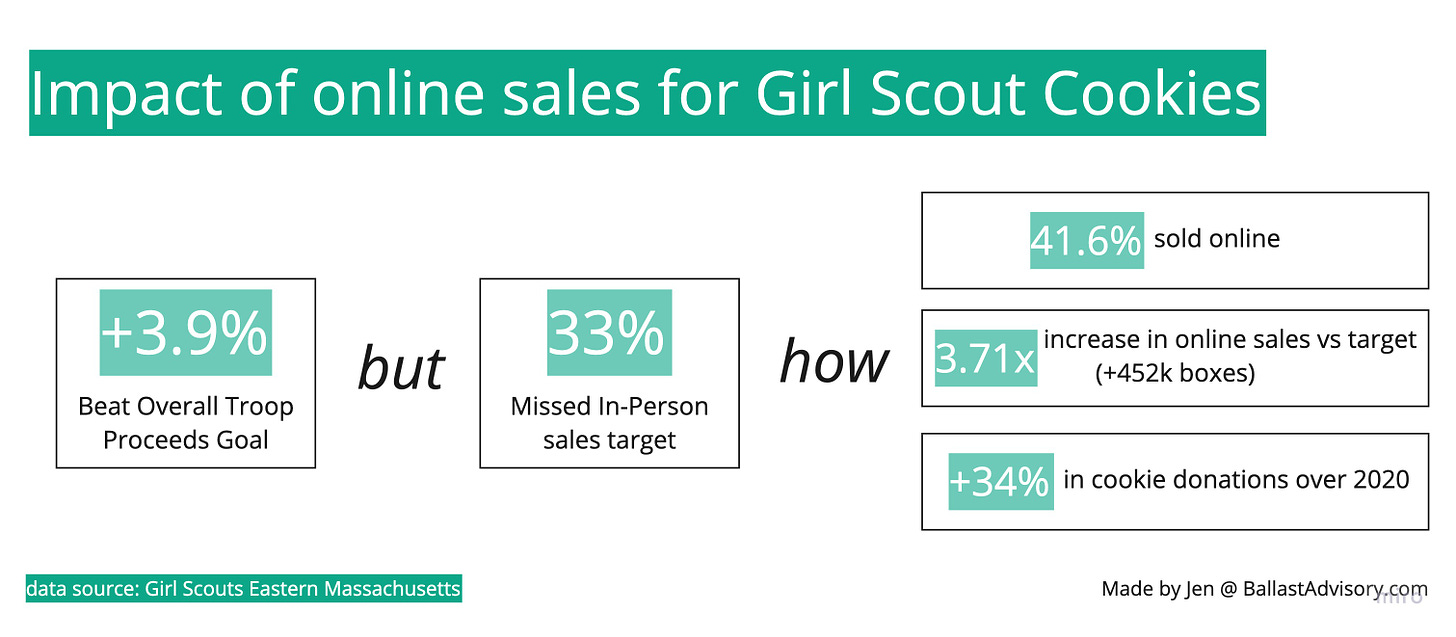

The Eastern Mass Girl Scouts are nice enough to publish a report highlighting their 2021 cookie sales. Although each year is unique, the region beat its online sales target by nearly a half million boxes, representing 42% of all sales.

The Girl Scouts have valid concerns about protecting their brand image and keeping profits local. That being said, it is unlikely that customers are contemplating their contribution to enriching activities for adolescent girls while they open that box of Thin Mints. The new partnership with Grubhub for 2021 was an excellent example of untapped potential.

The Grubhub pilot enabled the troops to access a novel distribution channel on their own terms while preserving margin. While it is not known how many troops participated, 100 of the 111 councils nationwide partnered with Grubhub. Although historically delivery services have received poor press for merchant fees, Grubhub waived all fees to ensure the Girl Scouts received the maximum proceeds.

🔮 What’s next?

It’ll be interesting to see what the 2022 cookie season looks like for the Girl Scouts. The mystery of the 15 million excess cookies remains as it is clear the pandemic is not solely to blame.

Are these problems that you are trying to solve for your business? Or maybe you just like to talk about eCommerce and digital strategies? Let’s talk.

This post can also be found on my website.